Despite the government’s repeated assurances of providing meaningful tax relief and protecting salaried individuals from overburdening, the federal budget 2025-26 offers only modest and largely symbolic reductions in tax rates for the salaried class.

Although the Finance Minister Muhammad Aurangzeb in his budget speech in the National Assembly, announced cuts—such as lowering the tax rate for incomes between Rs 600,000 and Rs 1.2 million to as low as 1 per cent—these measures fall short of expectations, failing to address more general demand for a higher exemption threshold and complete tax reforms.

The salaried groups have criticised the budget as insufficient, pointing out that growing living expenses and ongoing inflation swiftly outweigh any relief. Consequently, even with the language of reducing the tax load, the actual policies provide no real relief to most salaried workers, who remain among the most taxed groups in the nation.

Following recent history, the federal government has avoided announcing a new minimum wage for unskilled workers in the federal budget for 2025–26. Under the 18th Amendment, minimum wage announcements are mostly made by the provincial government; although the federation usually sets the benchmark for the Islamabad Capital Territory and shapes the baseline for other provinces to follow.

General Secretary of the National Trade Union Federation Pakistan (NTUF), Nasir Mansoor, has criticised the federal budget, saying it is unsatisfactory for workers. He said the strong elite create this budget for their benefit.

Mansoor said that the government’s inaction to declare a minimum pay for millions of private sector employees is obvious proof of its cruelty at a time when half of the population of the nation is compelled to live a subhuman, animal-like life below the poverty line. He also mentioned very low increases in pensions and pay for government staff members.

Mansoor insisted that pensions be raised to the level of the minimum wage and that the minimum pay should be Rs. 50,000. Furthermore, he underlined the need for a livable salary as the benchmark for pay and a minimum 30 per cent rise in government employee compensation.

Sharp Increase in Defence Budget Under Indian Tension

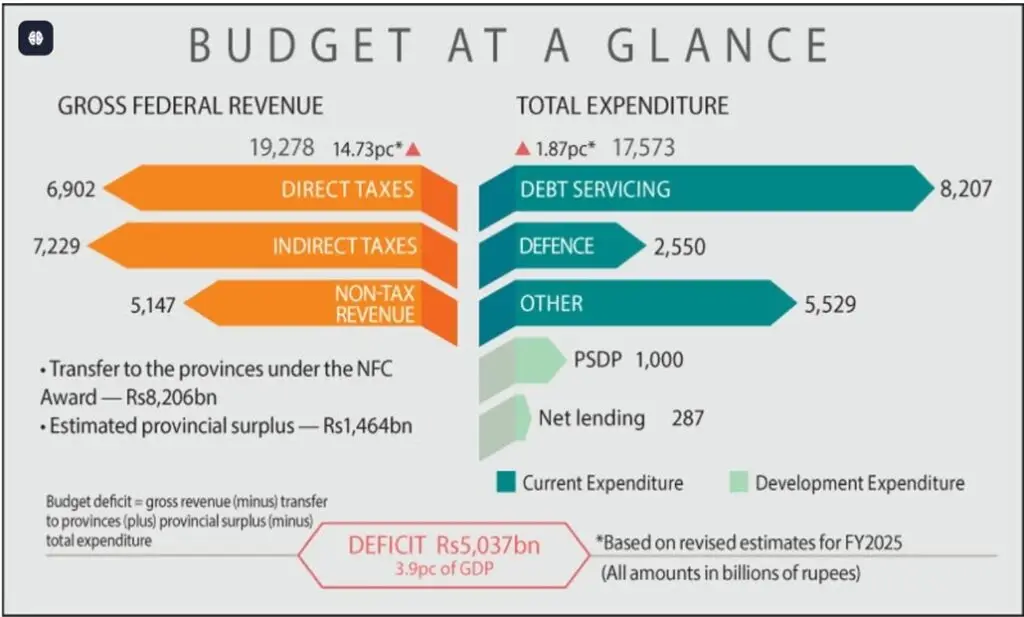

Pakistan’s federal budget for 2025-26 has handed a huge boost to defence spending, with a projected allocation of Rs 2.55 trillion—up by 20.2 per cent from last year’s Rs 2.122 trillion, marking the greatest yearly hike in almost a decade. This increase boosts defence expenditure to 1.97 per cent of GDP, up from 1.7 per cent, and its percentage of the total federal outlay to 14.51 per cent, the highest in recent years. The action comes amid heightened tensions with India, following recent military clashes with India, and ongoing internal security operations in Khyber Pakhtunkhwa and Balochistan.

Pakistan’s overall federal budget for 2025–26 is set to drop by 7 per cent to Rs17.57 trillion ($62 billion), reflecting fiscal tightening and the necessity to fulfil IMF commitments, even if defence expenditure is rising sharply.

Following a 9.5% increase from the year before, India’s defence budget for 2025–26 is $78.7 billion, nearly nine times more than Pakistan’s. The present defence budget for Pakistan now far exceeds financing for projects related to climate change, agriculture, and education.

“Austerity Budget”

Pakistan’s federal budget for the fiscal year 2025-26 is being widely labelled as an “austerity budget” that delivers just “crumbs” for relief to the population. The budget illustrates the government’s uncompromising attitude on fiscal consolidation, partly mandated by the constraints of the International Monetary Fund (IMF), while striving to balance the needs of its people, already collapsing under inflation and economic hardship.

Farooq Tariq, President, Huqooq Khalq Party, said: This is an imperialist budget that will further raise inequality, inflation, and unemployment among the people of Pakistan, while enhancing the profits of capitalist classes and international financial institutions.

He said that steps to further improve the earnings of the capitalist classes. The super tax levied on corporations has been decreased, he said.

Meagre Relief for the Salaried Class

The finance minister recommended a reduction in income tax by half, to 2.5 per cent on yearly income between Rs 600,000 and Rs 1.2 million. There is significant controversy regarding the tax rate for the lowest taxable category, with the finance bill indicating an even lower rate of 1 per cent. The annual tax on a salary of Rs 1.2 million was recommended to be reduced to Rs 6,000, down from the current Rs 30,000.

For those earning up to Rs 2.2 million per annum, the income tax rate would be slashed to 11 per cent, down from the present 15 per cent. The tax rate for salaried income between Rs 2.2 million and Rs 3.2 million would be cut to 23 per cent from 25 per cent. The government also addressed the issue of “brain drain” caused by harsh tax rates, offering a 1 per cent reduction in the surcharge on yearly revenues over Rs 10 million as a corrective step.

Even though the civilian government employees are offered a 10 per cent raise in salary and a 7 per cent rise in pensions, armed services personnel would enjoy a 25 per cent boost in salary, including a special relief allowance in acknowledgement of their recent performance in response to Indian aggression.

Carbon Levy and Tax on Solar Panels

The government has unveiled a new fiscal policy targeting both the solar energy sector and fossil fuel consumption. In the budget, an 18 per cent tax has been levied on imported solar panels, a measure meant to bolster local manufacturing and establish a level playing field between domestic and foreign companies. Meanwhile, a carbon levy of Rs 2.5 per litre has been introduced on petroleum products—including petrol, diesel, and furnace oil—with plans to increase this levy to Rs 5 per litre in the next fiscal year. This is in addition to the levy on petroleum, which is notified regularly.

The carbon levy is intended to produce significant money for investment in renewable energy and climate adaptation programs, while the solar panel tax is intended to stimulate the growth of Pakistan’s domestic solar industry. Your meeting tomorrow is likely to discuss the projected rise of the carbon fee to 5% in the coming year.

Dismal Allocations for Social Sector

While the budget outlines a plan for fiscal consolidation and deficit reduction, it does so at the price of development and public welfare measures. The reduction in subsidies and the implementation of additional taxes and surcharges are anticipated to raise the financial burden on regular individuals, particularly those in the lower and middle-income levels.

The Higher Education Commission (HEC) gets Rs39.5 billion for continuous projects in education, an extra Rs4.8 billion for research and technology programs. Especially, Rs9.8 billion is set aside for early childhood education centres, computer labs, and the National Institute of Excellence; another 11 new “Daanish Schools” in less developed areas are funded here as well. With just Rs 1 billion for new projects, higher education has seen a notable decline in development funding, from Rs 66.3 billion last year to Rs 39.4 billion this year.

With Rs 14.3 billion for ongoing projects, including hospitals and disease control initiatives, the health sector receives a limited budget. Reflecting financial constraints and an emphasis on finishing current projects, the PSDP does not include any new health schemes. Though the budget shows ongoing dedication to social sector growth, austerity, strong reliance on provincial funding, and minimal new investments in health and education moderate it overall.

Budget 2025-26: New Taxes on E-commerce

Pakistan’s 2025-26 budget contains new levies on both domestic and foreign e-commerce, making online buying pricier for customers. The Finance Bill alters the Income Tax Ordinance to define e-commerce platforms and “digitally delivered services,” which now encompass any sale or purchase via websites, mobile applications, or online marketplaces.

Local e-commerce enterprises will pay tax on all purchases made through their platforms, with digital payment taxes varying by amount: 1 per cent for up to Rs 10,000, 2 per cent for Rs 10,000–20,000, and 0.25 per cent for amounts beyond Rs 20,000. Cash-on-delivery will entail a 0.25 per cent tax on gadgets, 2 per cent on clothes, and 1 per cent on other purchases, collected by courier services.

Foreign e-commerce marketplaces—such as AliExpress and Amazon—will suffer a 5 per cent tax on items sold to Pakistan, collected via banks or payment gateways. Customs will block the shipment unless tax is paid. Foreign corporations will also pay a 5 per cent tax on social media advertising in Pakistan, with payment intermediaries forced to provide quarterly tax statements or face fines. Online sellers now have to register under the Sales Tax Act to sell on digital platforms, therefore strengthening the tax network on digital commerce.