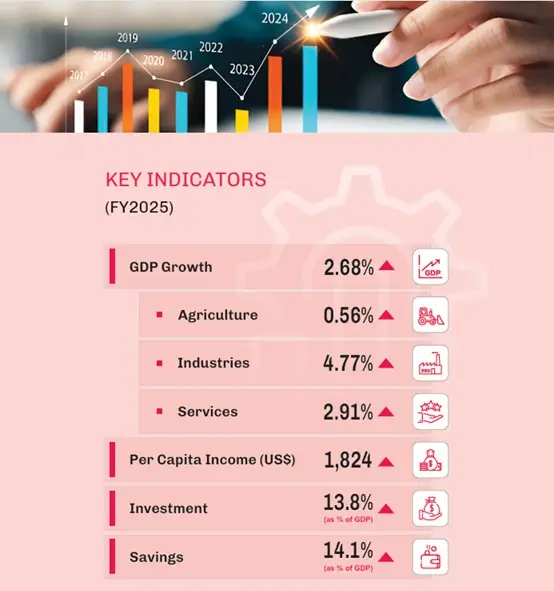

Finance Minister Muhammad Aurangzeb’s presented Pakistan’s Economic Survey 2024-25 on June 9, 2025. The survey reveals a clear reality despite government assertions of economic stability; most important benchmarks, particularly in agriculture, were failed by a great margin. While agriculture, a sector employing almost a third of the workforce, managed a dismal 0.56% increase against a 2% target, the overall GDP growth of 2.68% fell much below the 3.6% projection.

All significant crops, including wheat, cotton, sugarcane, and maize, all witnessed substantial losses, therefore undermining rural incomes and food security. This ongoing underperformance exposes the government’s inability to carry out sensible reforms, modernise agricultural methods, or safeguard the livelihoods of millions of people, therefore casting major questions on the legitimacy of its economic policies.

The Economic Survey 2024-25 indicates a 2.7% GDP growth rate for the departing fiscal year, a modest rebound from past lows but significantly short of the government’s initial target of 3.6%. This represents the third consecutive year of missing the growth targets, which raises issues regarding the effectiveness of policy formulation and execution. With the economy needing a near-miraculous 5.5% growth in the last quarter to fulfill even the amended objective, the quarterly growth figures of the National Accounts Committee—1.37% in Q1, 1.53% in Q2, and 2.4% in Q3—highlight the slowness of the recovery.

The government’s defence of the growth statistic highlights general macroeconomic stabilisation across several metrics. With an average inflation rate for July-April FY2025 at 4.7%, inflation has indeed dropped from a peak of 20.7% in April 2024 to just 0.3% in April 2025. The main surplus peaked at 3.0% while the fiscal deficit has dropped to 2.6% of GDP. Even though these macroeconomic successes are admirable, they conceal more fundamental problems with the actual economy.

Despite disappointment in getting targets, there were some positive indicators in the economy. “The government was able to tame the inflation substantially, which resulted in a decrease in interest rate,” commented Jibran Sarfraz, an analyst. He said in the budget, the government should try to bring more people into the tax net, which would help FBR to achieve its targets.

Even though there was growth in tax collection, the Federal Board of Revenue (FBR) fell short of its overall annual tax collection targets. By December 2024, the FBR had collected Rs 5,624.9 billion against a target of Rs 6,009 billion for the first half of the fiscal year, achieving 93.6% of the target and leaving a shortfall of Rs 384 billion. The full-year target was set at Rs 12,913 billion, with only 43.6% of this achieved in the first six months.

Dismal Performance of Agriculture and LSM

Employing more than 37% of the labour force and accounting for almost a quarter of GDP, the agriculture sector showed a dismal performance of 0.56%, mainly because of the government’s failed policies and withdrawal of its support to farmers. This is much below the 2% target and shows how sensitive the sector is to legislative neglect, lower farming areas, and bad weather. Among the major crops—wheat, cotton, sugarcane, maize, and rice—all showed notable reductions. Wheat by 8.9%; cotton by 30.7%; maize by 15.4%. A bright spot, the cattle industry expanded by 4.72%, but this was insufficient to overcome the more general agricultural malaise. Interestingly, potato and onion production increased by 11.5% and 15.9%, respectively.

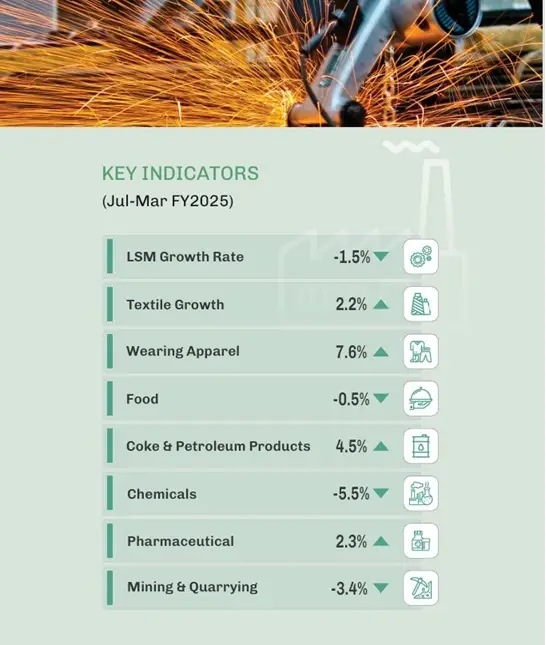

A major driver of industrial growth, large-scale manufacturing (LSM) also showed a dismal performance during the current fiscal year as it decreased by 1.47% in FY2025, the third straight year of negative growth. Pakistan’s industrial base is nonetheless hobbled by structural inefficiencies, supply chain interruptions, and high input costs. Though small-scale manufacturing and slaughtering distort the figure, which does not offset the underperformance of major industry, the industrial sector as a whole showed an increase of 4.77%. With major declines in the extraction of crude oil, natural gas, coal, and iron ore, the mining and quarrying industry also dropped 3.4%.

Comprising 58.4% of the GDP, the services industry expanded by 2.91%. Although this is encouraging, considering the sector’s dominance and the necessity of more development to accommodate the country’s growing young population, it is hardly a reason for jubilation.

Driven by a 36.7% increase in total revenues and a 26.3% gain in tax collections, the survey shows a clear drop in the fiscal deficit and a record primary surplus. Nonetheless, rather than consistent income generation, these increases are partially the product of one-off policies, including the petroleum charge and increased collections from the State Bank of Pakistan’s earnings. Though this is not a consistent source of long-term fiscal success, non-tax revenues climbed an amazing 68%.

On the outside, the current account balance changed from a $1.3 billion deficit in the year before to a $1.9 billion surplus in July–April FY2025. Remittances, which rose about 31% year-on-year to $31.2 billion, were mostly responsible for this turnabout. Although remittances offer a necessary buffer, they are a volatile source of foreign cash and do not solve Pakistan’s fundamental structural problems about exports.

With imports rising by 11.8% while exports grew by only 6.8%, the trade deficit in goods worsened to $21.3 billion. Higher dividend repatriation and interest payments drove the main income account deficit to $7.1 billion, while the services account deficit also grew. Reflecting a cautious investor mood amid global and regional uncertainty, foreign direct investment fell by 2.7%.

Reacting to lowering inflation, the State Bank of Pakistan (SBP) has sharply lowered the policy rate from 22% to 11%. Although this has helped private sector credit expansion and reduced borrowing rates, it raises doubts about the viability of inflation control. Administrative policies, relief programs, and policy changes, rather than basic changes in supply-side dynamics, account for some of the very sudden decline in inflation. Should these policies be loosened or external shocks recur, inflation might swiftly recover.

Social Sectors: Underappreciated Concerns

The survey gives social safety, education, and health some attention, but the ground reality stays dismal. With a notable gender disparity (68% for men, 52.8% for women) and clear urban-rural discrepancies, the literacy rate is 60.7%. With 69% of Balochistan’s out-of-school children (OOSC) absent, the percentage is shockingly 38%. Although the government has provided the Higher Education Commission with Rs 61.1 billion, given the scope of the problem, this is only a drop in the ocean.

Though Pakistan still lags behind regional rivals in important health indices, overall spending on health has increased by 9.7%. Though execution is still poor and coverage is restricted, the government has started various campaigns to fight malnutrition and non-communicable disorders.

Climate Change—Rhetoric vs. Reality

Among the nations most vulnerable to climate change is Pakistan; nevertheless, its reaction is still insufficient. Although the government has received $1.4 billion under the Resilience and Sustainability Facility of the IMF and started projects like Recharge Pakistan and the Pakistan Glacier Protection Strategy, these initiatives are not enough to handle the scope of the problem. Though coordination is lacking and financing is limited, provincial governments have taken some action.

The Economic Survey 2024-25 presents a nation at a crossroads. Although the macroeconomy has been stabilised by government efforts, these have come at the expense of ignoring the actual economy and long-term structural changes. The pressing need to solve agricultural stagnation, industrial decline, and social sector neglect has been lost in the focus on budget reduction and inflation control.

Although the survey notes the value of structural changes, education, and skill development, there is not much proof of actual action. Though it would need consistent political will and institutional capacity to produce results, the government’s URAAN Pakistan framework, which stresses export-led and investment-driven development, is in the correct direction.

Conclusion: A Lost Chance for Diversity of Growth

The Economic Survey of Pakistan 2024–25 is a contradictory document. It honours fiscal discipline and macroeconomic stabilisation while glossing over the inability to attain inclusive development and solve fundamental flaws. Although in some areas the government’s performance is commendable, it does not meet what is required to change Pakistan’s economy and raise the quality of living for its people.

Policymakers have to give long-term reforms top priority as the nation gets ready for the annual budget and goes beyond temporary remedies. Only then will Pakistan be able to realise the inclusive, sustainable development its people are due.